Multiple Wave Relationships

We have found that predetermined price objectives are useful in that if a reversal occurs at that level and the wave count is acceptable, a doubly significant point has been reached. When the market ignores such a level or gaps through it, you are put on alert to expect the next calculated level to be achieved. As the next level is often a good distance away, this can be extremely valuable information. Moreover, targets are based upon the most satisfying wave count. Thus, if they are not met or are exceeded by a significant margin, in many instances you will be forced in a timely manner to reconsider your preferred count and investigate what is then rapidly becoming a more attractive interpretation. This approach helps keep you one step ahead of nasty surprises. It is a good idea to keep all reasonable wave interpretations in mind so you can use ratio analysis to obtain additional clues as to which one is operative.

Multiple Wave Relationships

Keep in mind that all degrees of trend are always operating on the market at the same time. Therefore, at any given moment the market will be full of Fibonacci ratio relationships, all occurring with respect to the various wave degrees unfolding. It follows that future levels that create several Fibonacci relationships have a greater likelihood of marking a turn than a level that creates only one.

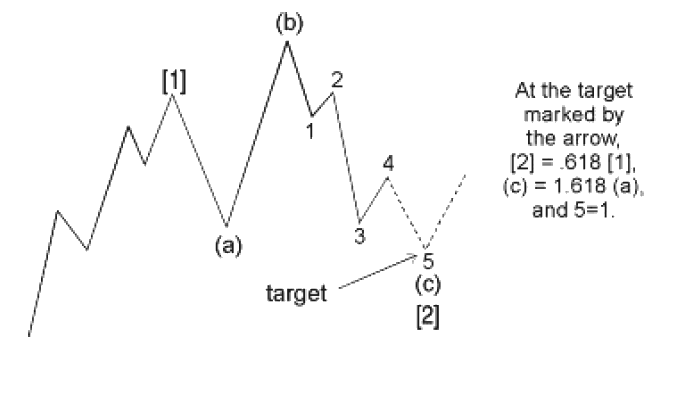

For instance, if a .618 retracement of a Primary wave [1] by a Primary wave [2] gives a particular target, and within it, a 1.618 multiple of Intermediate wave (a) in an irregular correction gives the same target for Intermediate wave (c), and within that, a 1.00 multiple of Minor wave 1 gives the same target yet again for Minor wave 5, then you have a powerful argument for expecting a turn at that calculated price level. Figure 4-15 illustrates this example.

Figure 4-15

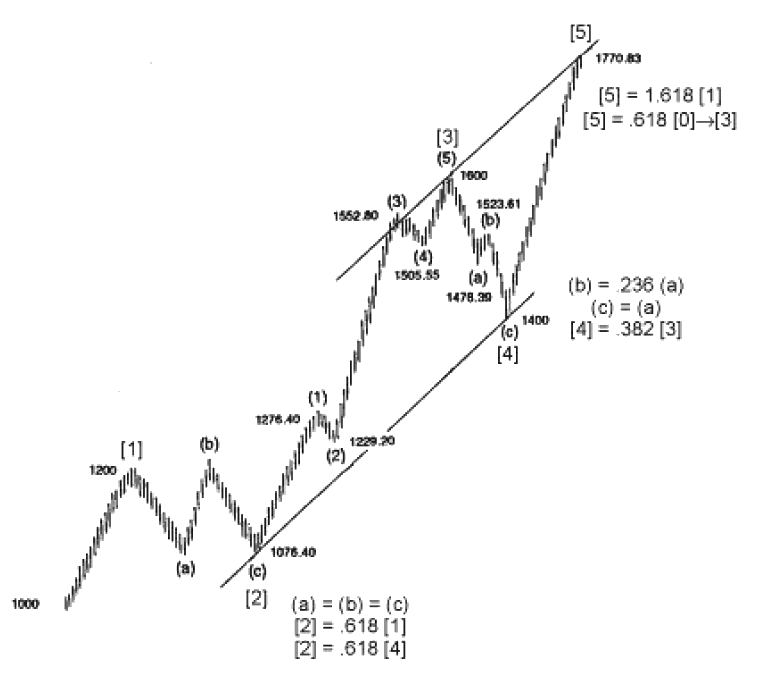

Figure 4-16 is an imaginary rendition of a reasonably ideal Elliott wave, complete with parallel trend channel. It has been created as an example of how ratios are often present throughout the market. In it, the following eight relationships hold:

[2] = .618 x [1];

[4] = .382 x [3];

[5] = 1.618 x [1];

[5] = .618 x [0] → [3];

[2] = .618 x [4];

in [2], (a) = (b) = (c);

in [4], (a) = (c);

in [4], (b) = .236 x (a)

Figure 4-16

If a complete method of ratio analysis could be successfully resolved into basic tenets, forecasting with the Elliott Wave Principle would become more scientific. It will always remain an exercise of probability, however, not certainty. Nature's laws governing life and growth, though immutable, nevertheless allow for an immense diversity of specific outcome, and the market is no exception. All that can be said about ratio analysis at this point is that comparing the price lengths of waves frequently confirms, often with pinpoint accuracy, the applicability to the stock market of the ratios found in the Fibonacci sequence. It was awe-inspiring, but no surprise to us, for instance, that the advance from December 1974 to July 1975 traced just over 61.8% of the preceding 1973-74 bear slide, or that the 1976-78 market decline traced exactly 61.8% of the preceding rise from December 1974 to September 1976. Despite the continual evidence of the importance of the .618 ratio, however, our basic reliance must be on form, with ratio analysis as backup or guideline to what we see in the patterns of movement. Bolton's counsel with respect to ratio analysis was, "Keep it simple." Research may still achieve further progress, as ratio analysis is still in its infancy. We are hopeful that those who labor with the problem of ratio analysis will add worthwhile material to the Elliott approach.