Details of the Complete Cycle

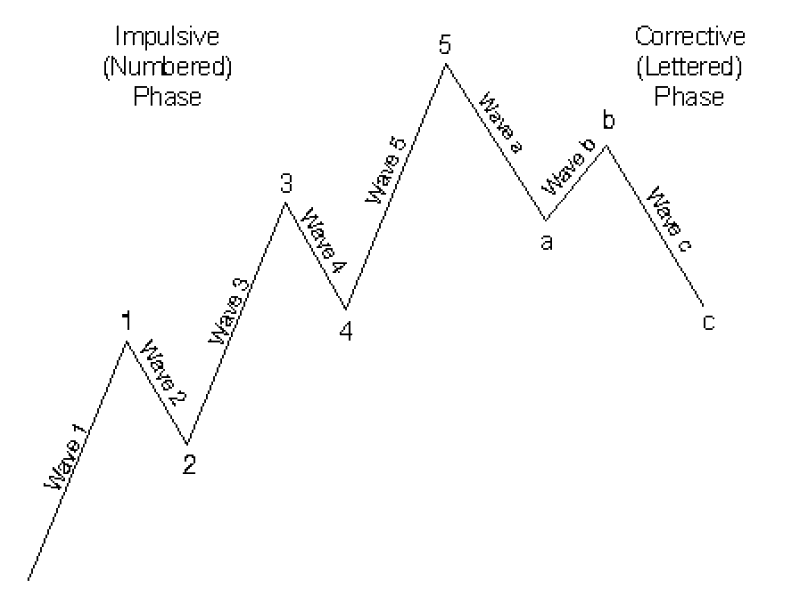

In his 1938 book, The Wave Principle, and again in a series of articles published in 1939 by Financial World magazine, R.N. Elliott pointed out that the stock market unfolds according to a basic rhythm or pattern of five waves up and three waves down to form a complete cycle of eight waves. The pattern of five waves up followed by three waves down is depicted in Figure 1-2.

Figure 1-2

One complete cycle consisting of eight waves, then, is made up of two distinct phases, the motive phase (also called a "five"), whose subwaves are denoted by numbers, and the corrective phase (also called a "three"), whose subwaves are denoted by letters. The sequence a, b, c corrects the sequence 1, 2, 3, 4, 5 in Figure 1-2.

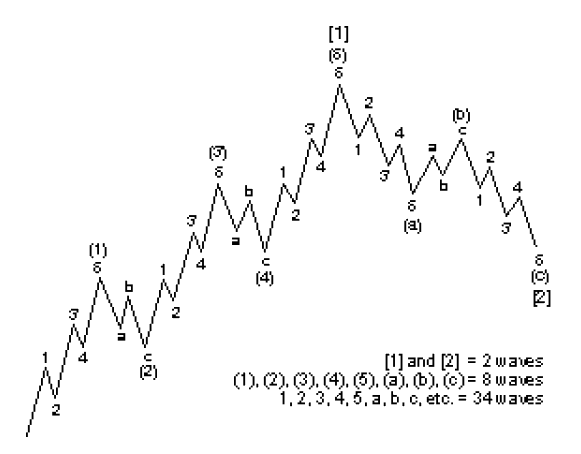

At the terminus of the eight-wave cycle shown in Figure 1-2 begins a second similar cycle of five upward waves followed by three downward waves. A third advance then develops, also consisting of five waves up. This third advance completes a five wave movement of one degree larger than the waves of which it is composed. The result is as shown in Figure 1-3 up to the peak labeled (5).

Figure 1-3

At the peak of wave (5) begins a down movement of correspondingly larger degree, composed once again of three waves. These three larger waves down "correct" the entire movement of five larger waves up. The result is another complete, yet larger, cycle, as shown in Figure 1-3. As Figure 1-3 illustrates, then, each same-direction component of a motive wave, and each full-cycle component (i.e., waves 1 + 2, or waves 3 + 4) of a cycle, is a smaller version of itself.

It is crucial to understand an essential point: Figure 1-3 not only illustrates a larger version of Figure 1- 2, it also illustrates Figure 1-2 itself, in greater detail. In Figure 1-2, each subwave 1, 3 and 5 is a motive wave that will subdivide into a "five," and each subwave 2 and 4 is a corrective wave that will subdivide into an a, b, c. Waves (1) and (2) in Figure 1-3, if examined under a "microscope," would take the same form as waves [1]* and [2]. All these figures illustrate the phenomenon of constant form within ever-changing degree.

The market's compound construction is such that two waves of a particular degree subdivide into eight waves of the next lower degree, and those eight waves subdivide in exactly the same manner into thirty-four waves of the next lower degree. The Wave Principle, then, reflects the fact that waves of any degree in any series always subdivide and re-subdivide into waves of lesser degree and simultaneously are components of waves of higher degree. Thus, we can use Figure 1-3 to illustrate two waves, eight waves or thirty-four waves, depending upon the degree to which we are referring.

The Essential Design

Now observe that within the corrective pattern illustrated as wave [2] in Figure 1-3, waves (a) and (c), which point downward, are composed of five waves: 1, 2, 3, 4 and 5. Similarly, wave (b), which points upward, is composed of three waves: a, b and c. This construction discloses a crucial point: that motive waves do not always point upward, and corrective waves do not always point downward. The mode of a wave is determined not by its absolute direction but primarily by its relative direction. Aside from four specific exceptions, which will be discussed later in this course, waves divide in motive mode (five waves) when trending in the same direction as the wave of one larger degree of which it is a part, and in corrective mode (three waves or a variation) when trending in the opposite direction. Waves (a) and (c) are motive, trending in the same direction as wave [2]. Wave (b) is corrective because it corrects wave (a) and is countertrend to wave [2]. In summary, the essential underlying tendency of the Wave Principle is that action in the same direction as the one larger trend develops in five waves, while reaction against the one larger trend develops in three waves, at all degrees of trend.

*Note: For this course, all Primary degree numbers and letters normally denoted by circles are shown with brackets.