Essential Concepts

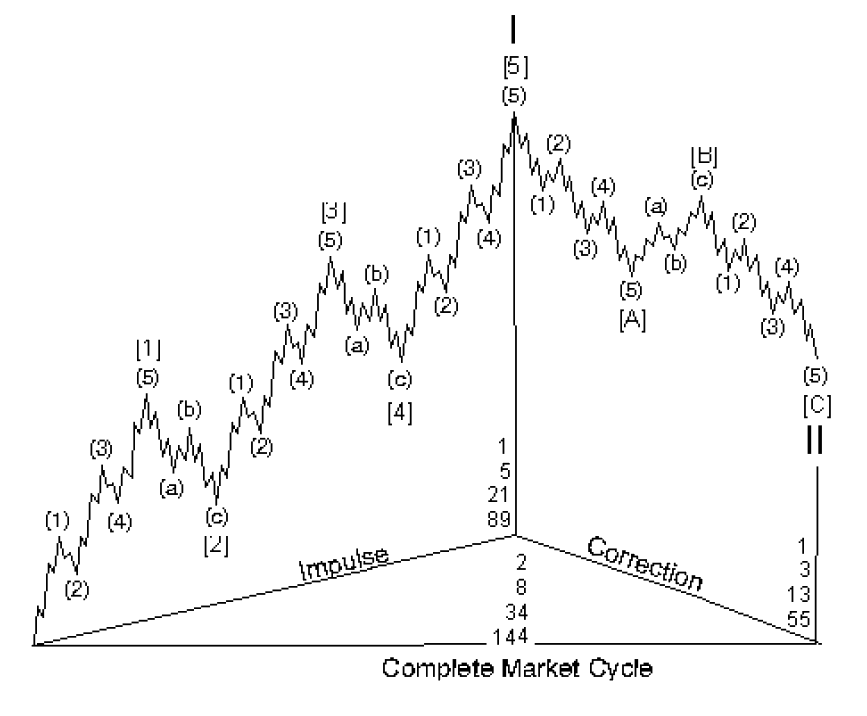

Figure 1-4

The phenomena of form, degree and relative direction are carried one step further in Figure 1-4. This illustration reflects the general principle that in any market cycle, waves will subdivide as shown in the following table.

Number of Waves at Each Degree

Impulse + Correction = CycleLargest waves 1+1=2

Largest subdivisions 5+3=8

Next subdivisions 21+13=34

Next subdivisions 89+55=144

As with Figures 1-2 and 1-3 in Lesson 2, neither does Figure 1-4 imply finality. As before, the termination of yet another eight wave movement (five up and three down) completes a cycle that automatically becomes two subdivisions of the wave of next higher degree. As long as progress continues, the process of building to greater degrees continues. The reverse process of subdividing into lesser degrees apparently continues indefinitely as well. As far as we can determine, then, all waves both have and are component waves.

Elliott himself never speculated on why the market's essential form was five waves to progress and three waves to regress. He simply noted that that was what was happening. Does the essential form have to be five waves and three waves? Think about it and you will realize that this is the minimum requirement for, and therefore the most efficient method of, achieving both fluctuation and progress in linear movement. One wave does not allow fluctuation. The fewest subdivisions to create fluctuation is three waves. Three waves in both directions does not allow progress. To progress in one direction despite periods of regress, movements in the main trend must be at least five waves, simply to cover more ground than the three waves and still contain fluctuation. While there could be more waves than that, the most efficient form of punctuated progress is 5-3, and nature typically follows the most efficient path.

Variations on the Basic Theme

The Wave Principle would be simple to apply if the basic theme described above were the complete description of market behavior. However, the real world, fortunately or unfortunately, is not so simple. From here through Lesson 15, we will fill out the description of how the market behaves in reality. That's what Elliott set out to describe, and he succeeded in doing so.

All waves may be categorized by relative size, or degree. Elliott discerned nine degrees of waves, from the smallest wiggle on an hourly chart to the largest wave he could assume existed from the data then available. He chose the names listed below to label these degrees, from largest to smallest: Grand Supercycle, Supercycle, Cycle, Primary, Intermediate, Minor, Minute, Minuette, Subminuette. It is important to understand that these labels refer to specifically identifiable degrees of waves.

Cycle waves subdivide into Primary waves that subdivide into Intermediate waves that in turn subdivide into Minor and sub-Minor waves. By using this nomenclature, the analyst can identify precisely the position of a wave in the overall progression of the market, much as longitude and latitude are used to identify a geographical location. To say, "the Dow Jones Industrial Average is in Minute wave v of Minor wave 1 of Intermediate wave (3) of Primary wave [5] of Cycle wave I of Supercycle wave (V) of the current Grand Supercycle" is to identify a specific point along the progression of market history.

| Wave Degree | 5s With the Trend | 3s Against the Trend |

| Grand Supercycle* | [I] [II] [III] [IV] [V] | [A] [B] [C] |

| Supercycle | (I) (II) (III) (IV) (V) | (A) (B) (C) |

| Cycle | I II III IV V | A B C |

| Primary* | [1] [2] [3] [4] [5] | [A] [B] [C] |

| Intermediate | (1) (2) (3) (4) (5) | (A) (B) (C) |

| Minor | 1 2 3 4 5 | A B C |

| Minute* | [i] [ii] [iii] [iv] [v] | [a] [b] [c] |

| Minuette | (i) (ii) (iii) (iv) (v) | [a] [b] [c] |

| Subminuette | i ii iii iv v | a b c |

The most desirable form for a scientist is usually something like 11, 12, 13, 14, 15, etc., with subscripts denoting degree, but it's a nightmare to read such notations on a chart. The above tables provide for rapid visual orientation. Charts may also use color as an effective device for differentiating degree.

In Elliott's suggested terminology, the term "Cycle" is used as a name denoting a specific degree of wave and is not intended to imply a cycle in the typical sense. The same is true of the term "Primary," which in the past has been used loosely by Dow Theorists in phrases such as "primary swing" or "primary bull market." The specific terminology is not critical to the identification of relative degrees, and the authors have no argument with amending the terms, although out of habit we have become comfortable with Elliott's nomenclature.

The precise identification of wave degree in "current time" application is occasionally one of the difficult aspects of the Wave Principle. Particularly at the start of a new wave, it can be difficult to decide what degree the initial smaller subdivisions are. The main reason for the difficulty is that wave degree is not based upon specific price or time lengths. Waves are dependent upon form, which is a function of both price and time. The degree of a form is determined by its size and position relative to component, adjacent and encompassing waves.

This relativity is one of the aspects of the Wave Principle that make real time interpretation an intellectual challenge. Fortunately, the precise degree is usually irrelevant to successful forecasting since it is relative degree that matters most. Another challenging aspect of the Wave Principle is the variability of forms, as described through Lesson 9 of this course.

Wave Functions

Every wave serves one of two functions: action or reaction. Specifically, a wave may either advance the cause of the wave of one larger degree or interrupt it. The function of a wave is determined by its relative direction. An actionary or trend wave is any wave that trends in the same direction as the wave of one larger degree of which it is a part. A reactionary or countertrend wave is any wave that trends in the direction opposite to that of the wave of one larger degree of which it is part. Actionary waves are labeled with odd numbers and letters. Reactionary waves are labeled with even numbers and letters.

All reactionary waves develop in corrective mode. If all actionary waves developed in motive mode, then there would be no need for different terms. Indeed, most actionary waves do subdivide into five waves. However, as the following sections reveal, a few actionary waves develop in corrective mode, i.e., they subdivide into three waves or a variation thereof. A detailed knowledge of pattern construction is required before one can draw the distinction between actionary function and motive mode, which in the underlying model introduced so far are indistinct. A thorough understanding of the forms detailed in the next five lessons will clarify why we have introduced these terms to the Elliott Wave lexicon.