Practical Application

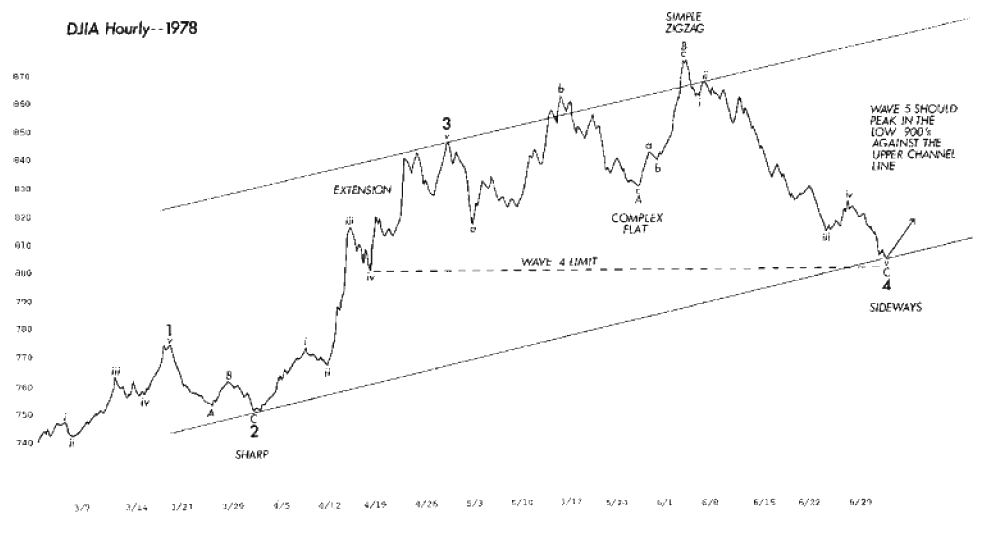

Because the tendencies discussed here are not inevitable, they are stated not as rules, but as guidelines. Their lack of inevitability nevertheless detracts little from their utility. For example, take a look at Figure 2-16, an hourly chart showing the first four Minor waves in the DJIA rally off the March 1, 1978 low. The waves are textbook Elliott from beginning to end, from the length of waves to the volume pattern (not shown) to the trend channels to the guideline of equality to the retracement by the "a" wave following the extension to the expected low for the fourth wave to the perfect internal counts to alternation to the Fibonacci time sequences to the Fibonacci ratio relationships embodied within. It might be worth noting that 914 would be a reasonable target in that it would mark a .618 retracement of the 1976-1978 decline.

Figure 2-16

There are exceptions to guidelines, but without those, market analysis would be a science of exactitude, not one of probability. Nevertheless, with a thorough knowledge of the guide lines of wave structure, you can be quite confident of your wave count. In effect, you can use the market action to confirm the wave count as well as use the wave count to predict market action.

Notice also that Elliott Wave guidelines cover most aspects of traditional technical analysis, such as market momentum and investor sentiment. The result is that traditional technical analysis now has a greatly increased value in that it serves to aid the identification of the market's exact position in the Elliott Wave structure. To that end, using such tools is by all means encouraged.

Learning the Basics

With a knowledge of the tools in Lessons 1 through 15, any dedicated student can perform expert Elliott Wave analysis. People who neglect to study the subject thoroughly or to apply the tools rigorously have given up before really trying. The best learning procedure is to keep an hourly chart and try to fit all the wiggles into Elliott Wave patterns, while keeping an open mind for all the possibilities. Slowly the scales should drop from your eyes, and you will continually be amazed at what you see.

It is important to remember that while investment tactics always must go with the most valid wave count, knowledge of alternative possibilities can be extremely helpful in adjusting to unexpected events, putting them immediately into perspective, and adapting to the changing market framework. While the rigidities of the rules of wave formation are of great value in choosing entry and exit points, the flexibilities in the admissible patterns eliminate cries that whatever the market is doing now is "impossible."

"When you have eliminated the impossible, whatever remains, however improbable, must be the truth." Thus eloquently spoke Sherlock Holmes to his constant companion, Dr. Watson, in Arthur Conan Doyle's The Sign of Four. This one sentence is a capsule summary of what one needs to know to be successful with Elliott. The best approach is deductive reasoning. By knowing what Elliott rules will not allow, one can deduce that whatever remains must be the most likely course for the market. Applying all the rules of extensions, alternation, overlapping, channeling, volume and the rest, the analyst has a much more formidable arsenal than one might imagine at first glance. Unfortunately for many, the approach requires thought and work and rarely provides a mechanical signal. However, this kind of thinking, basically an elimination process, squeezes the best out of what Elliott has to offer and besides, it's fun!

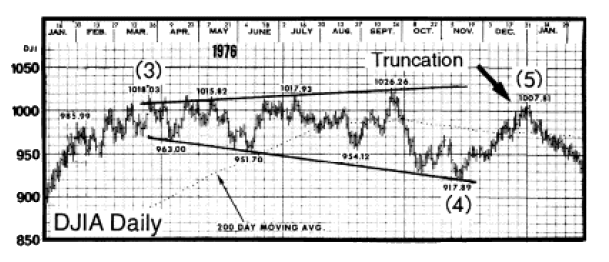

As an example of such deductive reasoning, take another look at Figure 1-14, reproduced below:

Figure 1-14

Cover up the price action from November 17, 1976 forward. Without the wave labels and boundary lines, the market would appear as formless. But with the Wave Principle as a guide, the meaning of the structures becomes clear. Now ask yourself, how would you go about predicting the next movement? Here is Robert Prechter's analysis from that date, from a personal letter to A.J. Frost, summarizing a report he issued for Merrill Lynch the previous day:

Enclosed you will find my current opinion outlined on a recent Trendline chart, although I use only hourly point charts to arrive at these conclusions. My argument is that the third Primary wave, begun in October of 1975, has not completed its course as yet, and that the fifth Intermediate wave of that Primary is now underway. First and most important, I am convinced that October 1975 to March 1976 was so far a three-wave affair, not a five, and that only the possibility of a failure on May 11th could complete that wave as a five. However, the construction following that possible "failure" does not satisfy me as correct, since the first downleg to 956.45 would be of five waves and the entire ensuing construction is obviously a flat. Therefore, I think that we have been in a fourth corrective wave since March 24th. This corrective wave satisfies completely the requirements for an expanding triangle formation, which of course can only be a fourth wave. The trendlines concerned are uncannily accurate, as is the downside objective, obtained by multiplying the first important length of decline (March 24th to June 7th, 55.51 points) by 1.618 to obtain 89.82 points. 89.82 points from the orthodox high of the third Intermediate wave at 1011.96 gives a downside target of 922, which was hit last week (actual hourly low 920.62) on November 11th. This would suggest now a fifth Intermediate back to new highs, completing the third Primary wave. The only problem I can see with this interpretation is that Elliott suggests that fourth wave declines usually hold above the previous fourth wave decline of lesser degree, in this case 950.57 on February 17th, which of course has been broken on the downside. I have found, however, that this rule is not steadfast. The reverse symmetrical triangle formation should be followed by a rally only approximating the width of the widest part of the triangle. Such a rally would suggest 1020-1030 and fall far short of the trendline target of 1090-1100. Also, within third waves, the first and fifth subwaves tend toward equality in time and magnitude. Since the first wave (Oct. 75-Dec.75) was a 10% move in two months, this fifth should cover about 100 points (1020-1030) and peak in January 1977, again short of the trendline mark.

Now uncover the rest of the chart to see how all these guidelines helped in assessing the market's likely path.

Christopher Morley once said, "Dancing is a wonderful training for girls. It is the first way they learn to guess what a man is going to do before he does it." In the same way, the Wave Principle trains the analyst to discern what the market is likely to do before it does it.

After you have acquired an Elliott "touch," it will be forever with you, just as a child who learns to ride a bicycle never forgets. At that point, catching a turn becomes a fairly common experience and not really too difficult. Most important, in giving you a feeling of confidence as to where you are in the progress of the market, a knowledge of Elliott can prepare you psychologically for the inevitable fluctuating nature of price movement and free you from sharing the widely practiced analytical error of forever projecting today's trends linearly into the future.

Practical Application

The Wave Principle is unparalleled in providing an overall perspective on the position of the market most of the time. Most important to individuals, portfolio managers and investment corporations is that the Wave Principle often indicates in advance the relative magnitude of the next period of market progress or regress. Living in harmony with those trends can make the difference between success and failure in financial affairs.

Despite the fact that many analysts do not treat it as such, the Wave Principle is by all means an objective study, or as Collins put it, "a disciplined form of technical analysis." Bolton used to say that one of the hardest things he had to learn was to believe what he saw. If the analyst does not believe what he sees, he is likely to read into his analysis what he thinks should be there for some other reason. At this point, his count becomes subjective. Subjective analysis is dangerous and destroys the value of any market approach.

What the Wave Principle provides is an objective means of assessing the relative probabilities of possible future paths for the market. At any time, two or more valid wave interpretations are usually acceptable by the rules of the Wave Principle. The rules are highly specific and keep the number of valid alternatives to a minimum. Among the valid alternatives, the analyst will generally regard as preferred the interpretation that satisfies the largest number of guidelines, and so on. As a result, competent analysts applying the rules and guidelines of the Wave Principle objectively should usually agree on the order of probabilities for various possible outcomes at any particular time. That order can usually be stated with certainty. Let no one assume, however, that certainty about the order of probabilities is the same as certainty about one specific outcome. Under only the rarest of circumstances does the analyst ever know exactly what the market is going to do. One must understand and accept that even an approach that can identify high odds for a fairly specific outcome will be wrong some of the time. Of course, such a result is a far better performance than any other approach to market forecasting provides.

Using Elliott, it is often possible to make money even when you are in error. For instance, after a minor low that you erroneously consider of major importance, you may recognize at a higher level that the market is vulnerable again to new lows. A clear-cut three-wave rally following the minor low rather than the necessary five gives the signal, since a three-wave rally is the sign of an upward correction. Thus, what happens after the turning point often helps confirm or refute the assumed status of the low or high, well in advance of danger.

Even if the market allows no such graceful exit, the Wave Principle still offers exceptional value. Most other approaches to market analysis, whether fundamental, technical or cyclical, have no good way of forcing a change of opinion if you are wrong. The Wave Principle, in contrast, provides a built-in objective method for changing your mind. Since Elliott Wave analysis is based upon price patterns, a pattern identified as having been completed is either over or it isn't. If the market changes direction, the analyst has caught the turn. If the market moves beyond what the apparently completed pattern allows, the conclusion is wrong, and any funds at risk can be reclaimed immediately. Investors using the Wave Principle can prepare themselves psychologically for such outcomes through the continual updating of the second best interpretation, sometimes called the "alternate count." Because applying the Wave Principle is an exercise in probability, the ongoing maintenance of alternative wave counts is an essential part of investing with it. In the event that the market violates the expected scenario, the alternate count immediately becomes the investor's new preferred count. If you're thrown by your horse, it's useful to land right atop another.

Of course, there are often times when, despite a rigorous analysis, the question may arise as to how a developing move is to be counted, or perhaps classified as to degree. When there is no clearly preferred interpretation, the analyst must wait until the count resolves itself, in other words, to "sweep it under the rug until the air clears," as Bolton suggested. Almost always, subsequent moves will clarify the status of previous waves by revealing their position in the pattern of the next higher degree. When subsequent waves clarify the picture, the probability that a turning point is at hand can suddenly and excitingly rise to nearly 100%.

The ability to identify junctures is remarkable enough, but the Wave Principle is the only method of analysis which also provides guidelines for forecasting, as outlined in Lessons 10 through 15 and 20 through 25 of this course. Many of these guidelines are specific and can occasionally yield results of stunning precision. If indeed markets are patterned, and if those patterns have a recognizable geometry, then regardless of the variations allowed, certain price and time relationships are likely to recur. In fact, real world experience shows that they do.

It is our practice to try to determine in advance where the next move will likely take the market. One advantage of setting a target is that it gives a sort of backdrop against which to monitor the market's actual path. This way, you are alerted quickly when something is wrong and can shift your interpretation to a more appropriate one if the market does not do what is expected. If you then learn the reasons for your mistakes, the market will be less likely to mislead you in the future.

Still, no matter what your convictions, it pays never to take your eye off what is happening in the wave structure in real time. Although prediction of target levels well in advance can be done surprisingly often, such predictions are not required in order to make money in the stock market. Ultimately, the market is the message, and a change in behavior can dictate a change in outlook. All one really needs to know at the time is whether to be bullish, bearish or neutral, a decision that can sometimes be made with a swift glance at a chart.

Of the many approaches to stock market analysis, the Elliott Wave Principle, in our view, offers the best tool for identifying market turns as they are approached. If you keep an hourly chart, the fifth of the fifth of the fifth in a primary trend alerts you within hours of a major change in direction by the market. It is a thrilling experience to pinpoint a turn, and the Wave Principle is the only approach that can occasionally provide the opportunity to do so. Elliott may not be the perfect formulation since the stock market is part of life and no formula can enclose it or express it completely. However, the Wave Principle is without a doubt the single most comprehensive approach to market analysis and, viewed in its proper light, delivers everything it promises.